Dave Ramsey How Much Car Can I Afford

How much car can you afford on a $50,000 salary?

Generally, it is best to spend no more than 10% of your gross salary ($5,000) on a vehicle. Dave Ramsey recommends spending no more than half your gross salary ($25,000) on a new vehicle. Spending too much money on cars leads to missed opportunity cost or financial strain.

Imagine, being able to drive off in a new vehicle without sacrificing your finances. You may not be getting a Lamborghini, but you'll have more money at the end of the day.

Car shopping is dangerous. It's so easy to want the fancy, top of the line, new vehicles.

Unfortunately, most families take on significant debt to finance cars they can't afford. This one purchase can set a person back on retirement for years!

Luckily for you, I'm going to show you how much car you can afford. You don't have to listen to me, but at least you can make an informed decision. Only you can decide if the cost of a vehicle is worth the impact to your finances.

This article may contain affiliate links which pays a commission and supports this blog. Thank you for your support!

How much car can I afford on a $50,000 salary?

On a $50,000 salary, it is recommended you don't spend more than $5,000 (10%) on a car. Dave Ramsey recommends spending no more than half your gross annual income ($50k) on a new car. However, the cost of a car really includes purchase price, opportunity cost of investments, or loan interest.

Start by making a budget if you don't already have one. You'll need to understand how much free cash you actually have. You also need to decide if you're going to take out a car loan, which is not recommended.

Paying in cash is always preferred, but not always possible.

So let's take a look at a couple scenarios, assuming you're a new college graduate with a $50k salary. Most college graduates make the mistake of taking their savings and purchasing a new car.

Click to Tweet! Please Share! Click To Tweet

Evaluating the opportunity cost of a new car

You have two choices, buy a $5,000 or a $25,000 car. Let's assume you've got $25,000 on hand to make this purchase.

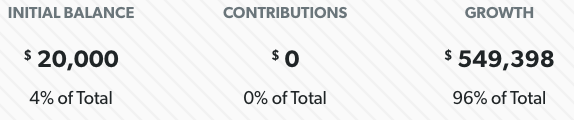

Unfortunately, you went with buying a new car for $25k. You could have invested the $20k difference. Using an investment calculator, your $20k would have grown to $570k from age 25 to 67 at 8% return.

Now, let's assume you only had $5,000 to spend on a new car. Assuming you want the new car, you'll need a car loan.

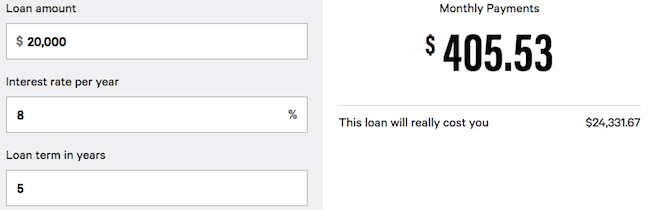

According to Bankrate, your interest rate on an auto loan will be anywhere from3.65%-17.74%! Loan terms are expected between two and seven years!

As a college graduate, your credit score is most likely low. Assuming an 8% interest rate and a five year term, we can estimate the true cost of your loan. Your monthly payments would be $405.53, costing you a total of $24,331.67!

So not only are you spending an extra $4.3k, but you're also missing out on potential investment returns. Cars also tend to depreciate in value over time, so your car makes you lose money.

How much is too much for a car payment?

Generally, paying more than 10% of your income for a used car or 50% for a new car is considered too much. Ultimately, the deciding factor should be your overall financial situation to guide your car payments. You should be able to afford your expenses, savings goals, and use leftover cash for a car payment.

Remember, personal finance is personal. Only you know how your money will benefit your life the best. If you can meet your financial responsibilities then you can splurge on cars.

My only recommendation is that you consider the opportunity cost. Transportation is one of the biggest expenses you'll face. Debt, such as a car payment, does not help you build wealth.

As previously mentioned, start with your budget. You should have a plan for your income 2 plan your monthly expenses, emergencies, and still be on track for retirement.

Once your budget is completed, is there any spare money left over? You can use this for a car payment provided no better alternatives exist.

So let's say you're comfortable spending $300 per month on a car payment. You visit the dealer, but the payments come out to $350. What do you do?

You can either revisit your budget and see if you can find an extra $50 per month. However, it's probably best just to save up for down payment on your new car. With a substantial down payment, you can greatly reduce your monthly payments.

Is it ok to finance a car?

Your personal finance situation will dictate if it is okay for you to finance a car. Keep in mind, your car will depreciate in value while you are making payments. New cars depreciate 20 to 30% in the first year. Therefore, your car may be worth less than you owe on the car.

Again, this will all come down to your personal budget if you can make the payments. Personally, I would avoid taking on additional debt. What would happen if you lost your job tomorrow?

You should also factor in the cost of your car payments when building your emergency fund. Remember, losing your job is hard, but it is even harder when you have a car payment. Failure to repay your car loan may result in repossession of your car.

Your car tends to depreciate in value very rapidly. The more you drive your car, the further away from the original value your car gets. Your car loses value quicker, the newer it is.

Imagine, purchasing a car from a dealer for $25,000. You've been driving the car for one year and lost your job. You've decided that you cannot make the payments and want to sell your car.

Unfortunately for you, cars depreciate 20 to 30% in the first year. You owe the bank $24,000, but the car is now only worth $18,000. It's a bad situation to be in, but it happens all the time.

When's the best time to buy a car?

The last three month of the year (October, November, and December) are the best time to buy a car. Dealerships are trying to clear out room for the new models and they're trying to meet sales quotas.

Essentially, January is the worst time of year to buy a car. The closer you get to December the better your chances of getting a good deal.

Click to Tweet! Please Share! Click To Tweet

Summary: How much car can I afford on $50k salary

As you can see, you probably shouldn't spend more than 10% of your $50,000 salary on a used car. Dave Ramsey recommends no more than half of your gross salary for a new car. However, you need to consider the opportunity cost when buying a car.

You can earn more money investing the cost of a car. Cars tend to depreciate in value and lose money over time. Most people make the mistake of buying high end cars, which has a significant impact on their finances.

Auto loans should also play a factor in your decision. Your $25k car would end up costing you much more in interest. Your car will depreciate in value, meaning you're going to owe more than the car is worth.

Before you buy a car, it's important to have a budget in place. A good budget allows you to understand how much money you really have for a car.

My personal recommendation is to avoid financing a car. Pay in cash when you can. Avoid buying expensive cars, because investing will lead to more money later down the road.

Dave Ramsey How Much Car Can I Afford

Source: https://tightfistfinance.com/how-much-car-can-i-afford-on-50k-salary/

0 Response to "Dave Ramsey How Much Car Can I Afford"

Post a Comment